darellbarraza5

About darellbarraza5

The Necessity of Personal Loans for People with Unhealthy Credit Score

In a world where monetary stability is often a cornerstone of private and professional success, many individuals find themselves grappling with poor credit score scores that hinder their potential to access essential funding. For those with dangerous credit, the need for personal loans can change into a pressing subject, as these loans can present a much-needed lifeline in occasions of financial distress. This text explores the reasons behind the growing demand for personal loans among people with bad credit, the challenges they face, and the potential solutions obtainable to them.

Understanding Unhealthy Credit score

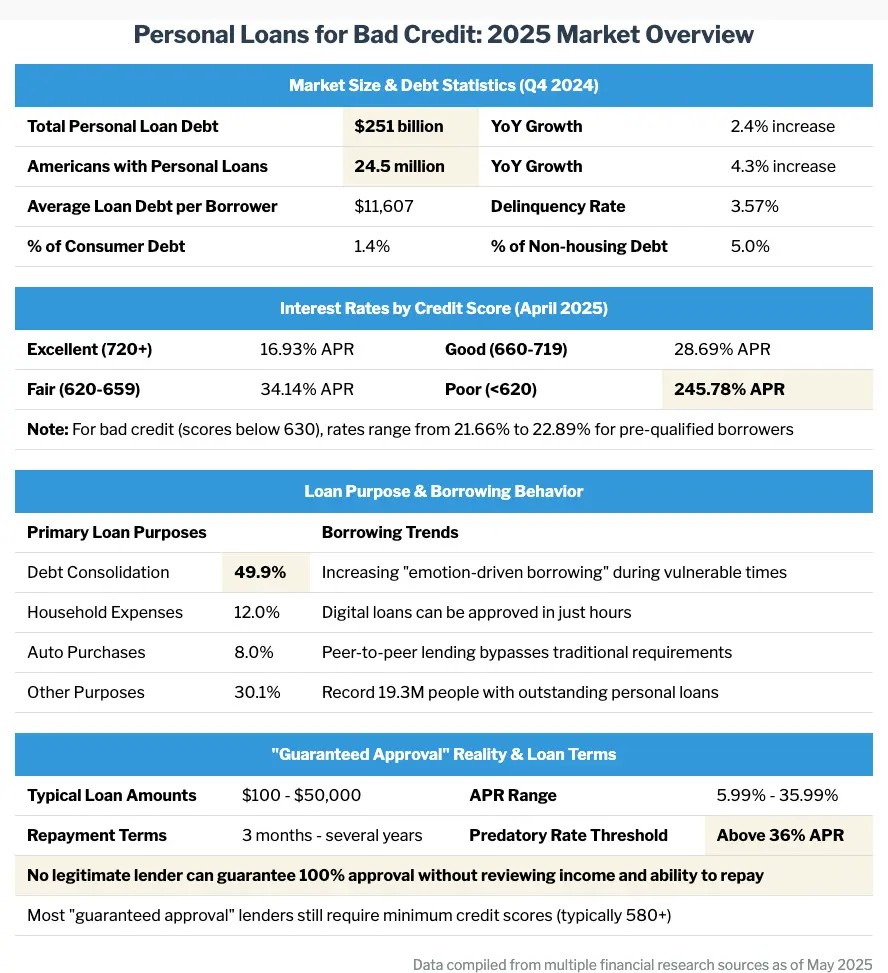

Bad credit is usually defined as a credit score rating below 580, based on the FICO scoring mannequin. This rating can consequence from numerous components, together with missed funds, high credit utilization, or a history of bankruptcy. People with dangerous credit typically face important barriers when seeking loans, as traditional lenders view them as excessive-danger borrowers. Consequently, they may be denied credit altogether or offered loans with exorbitant interest charges that can exacerbate their financial struggles.

The need for Personal Loans

Personal loans serve quite a lot of purposes, from consolidating debt to financing unexpected bills comparable to medical bills or house repairs. For individuals with dangerous credit score, the necessity for these loans will be notably acute. Many find themselves in situations the place they require fast entry to funds, yet their credit historical past limits their choices. Listed below are several the explanation why personal loans are important for these with unhealthy credit score:

- Debt Consolidation: Certainly one of the most typical causes individuals seek personal loans is to consolidate current debt. Excessive-curiosity credit score playing cards can create a cycle of debt that is tough to escape. A personal loan can allow individuals to pay off these debts and simplify their funds into a single, extra manageable month-to-month installment.

- Emergency Bills: Life is unpredictable, and emergencies can strike at any moment. Whether or not it’s a medical emergency, automotive restore, or urgent house maintenance, personal loans can provide the required funds to handle these unexpected costs. For those with bad credit, having access to a personal loan can mean the difference between financial restoration and further monetary hardship.

- Constructing Credit: Though it may seem counterintuitive, taking out a personal loan can really help individuals with unhealthy credit score enhance their credit rating. By making constant, on-time payments, borrowers can reveal their creditworthiness and rebuild their credit score history. This can open doors to better financial alternatives sooner or later.

- Avoiding Predatory Lending: People with bad credit score are sometimes targeted by predatory lenders who offer loans with exorbitant fees and curiosity charges. Personal loans from reputable lenders can present a safer alternative, permitting borrowers to safe funds with out falling sufferer to exploitative practices.

Challenges Faced by Borrowers with Dangerous Credit

While personal loans can be a precious useful resource for people with unhealthy credit score, obtaining them shouldn’t be with out challenges. Many lenders have stringent necessities that could make it troublesome for those with poor credit score histories to qualify. Listed here are a number of the common hurdles faced by borrowers:

- Excessive Interest Charges: Lenders typically cost higher interest rates to compensate for the perceived risk of lending to people with dangerous credit. This can result in loans that aren’t solely difficult to repay however can also lead to a cycle of debt if borrowers are unable to sustain with payments.

- Restricted Loan Amounts: Lenders may additionally limit the amount of cash they are keen to lend to individuals with bad credit. This may be significantly irritating for borrowers who need a bigger sum to address vital monetary challenges.

- Stringent Approval Processes: Many lenders have strict eligibility criteria, requiring borrowers to have a gradual revenue and a sure debt-to-earnings ratio. This can make it troublesome for individuals with unstable employment or other monetary burdens to qualify for a loan.

- Potential for Scams: The financial struggles confronted by people with bad credit score can make them extra vulnerable to scams. Unscrupulous lenders might prey on these individuals, offering loans with hidden fees and unfavorable terms. It is crucial for borrowers to conduct thorough research and seek out respected lenders.

Exploring Options

Regardless of the challenges, there are a number of solutions out there for individuals with unhealthy credit looking for personal loans. Listed below are some options to think about:

- Credit score Unions: Credit score unions are member-owned financial institutions that always have more lenient lending standards than conventional banks. They may additionally provide lower curiosity rates and charges, making them a viable possibility for these with dangerous credit.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with particular person buyers willing to fund their loans. These platforms typically have less stringent credit score necessities and can provide aggressive interest rates.

- Secured Loans: For people with dangerous credit, a secured loan may be an option value considering. These loans require collateral, similar to a vehicle or financial savings account, which might scale back the lender’s threat and potentially result in decrease curiosity charges.

- Co-Signers: Having a co-signer with good credit score can considerably improve the possibilities of loan approval and should result in more favorable phrases. If you’re ready to find out more info in regards to 5K Personal Loan Bad credit stop by our web page. Nonetheless, it is essential for each parties to grasp the risks involved, as the co-signer turns into accountable for the loan if the primary borrower defaults.

- Credit Counseling: Searching for help from a credit score counseling company can provide individuals with unhealthy credit the guidance they want to enhance their financial scenario. Counselors can help create a funds, negotiate with creditors, and develop a plan to rebuild credit score.

Conclusion

In conclusion, personal loans can function an important resource for people with dangerous credit score, providing them with the financial help needed to navigate difficult circumstances. Whereas the street to securing a loan could also be fraught with obstacles, understanding the choices available and taking proactive steps can empower borrowers to regain management of their financial futures. With the best approach, people with dangerous credit score can flip their financial challenges into opportunities for growth and stability.

No listing found.